The Best Accountants during Coronavirus

Collappor8 are working from home and remotely during the Coronavirus crisis crippling Australia right now. We are working tirelessly with our clients, and members of the Canterbury Bankstown Chamber of Commerce.

Our Management Consltants and our operations team power the CBCC offering strategic advice and are part of the panel for delivering CBCC Live TV. Soon Leah Ostermeyer & Jo Johnston will both be on the panel talking about the impact of coronavirus on businesses in Australia. Particularly on the stimulus package available for businesses and how to access, or apply for your stimulus package entitlements. If you are wondering, what are the government incentives for employers, or government incentives for small business then our accountants in Bankstown or Kingsgrove can assist you no matter where you are in Australia.

Our Management Consltants and our operations team power the CBCC offering strategic advice and are part of the panel for delivering CBCC Live TV. Soon Leah Ostermeyer & Jo Johnston will both be on the panel talking about the impact of coronavirus on businesses in Australia. Particularly on the stimulus package available for businesses and how to access, or apply for your stimulus package entitlements. If you are wondering, what are the government incentives for employers, or government incentives for small business then our accountants in Bankstown or Kingsgrove can assist you no matter where you are in Australia.

Accounting

Accounting is the fundamental basis on which all strategy can be built. Our findings show that clients want more strategic advice from their accounting team. We answer this demand by offering an all in one accounting service. Our all in one accounting service allows our clients to avail any or all of our accounting specialisations, allowing you to mix and match depending on your needs, your size, and your objectives. You can Outsource: CFO duties, financial accounting, management accounting or benefit from our virtual bookkeeping service, the choice is yours. By offering our all in one accounting service, we have all the information we need in-house, for collaboration, deliberation and strategic advice.

Collappor8 assess your current situation to identify opportunities. We recommend and implement solutions that fit your specific needs. Yes, we can prepare your business’s financial statements, arrange to lodge Activity Statements and Income Tax Returns through our outsourced service, but so can most accounting firms. We don’t start and end with compliance. We take the time to ensure you understand what the numbers are saying about your business, good and bad, then help your business be strategically proactive rather than reactive. We are constantly looking for opportunities to add value to your business. It’s our mission to empower Australian businesses to make decisions with confidence and experience higher commercial success.

At Collappor8, we believe in knowing your customer (“KYC”). We get to know our customers the same way we advise our customers to know their customers. The more we know, the more value we can add. Knowing your goals lets us plan for your future and keep you on track. If your goal is to “grow my business” or “open more stores” or “add additional products or services”, accounting is your starting point. Regular monitoring of a business’s financial performance is a perfect way to track progress. We can work with your existing finance team, stepping in and out of your business as required. We are around all year round, not just at tax time. The success of your business is our success and we love nothing more than seeing our clients get ahead.

Quite often the need for bookkeeping services and or financial accounting is driven by necessity and affordability. An accountant is an accountant is an accountant, right?

We don’t choose to spend our time and your money on data entry. We want to add real value to your business. Where possible we use cloud accounting and automation, however, we know that not all business work in the cloud, and that’s ok too, we can work with whatever system you’ve got. Your finances need financial vision, to be efficient, productive and effective. In today’s complex environment and competitive market – swift access to meaningful information will be paramount. We look for ways for you to embrace the power of automation, consider current developments in technology and what’s on the horizon – we’re here to help you every step of the way!

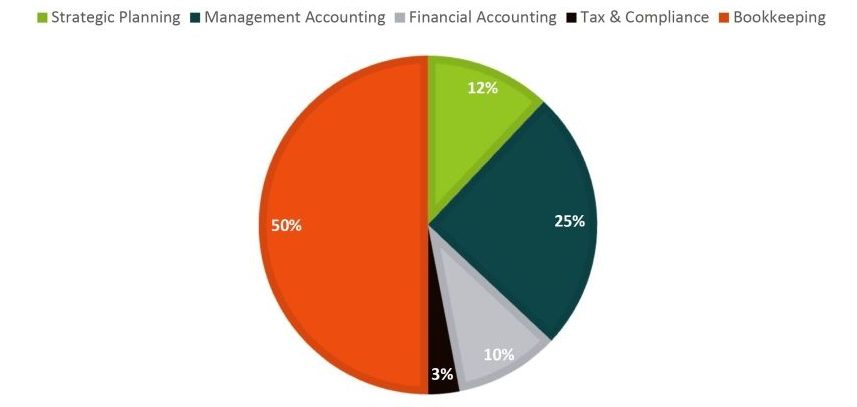

How Do You Allocate Your Accounting TimeTime is Money

How do you allocate your time and how you spend your accounting budget? How will this change over the next 12 months, or even the next 3 and 5 years with the evolution of technology and advancements in AI – machine Learning?

The Power of AutomationThe Future of Accounting

Automation has transformed the entire accounting industry which has led to a greater demand for accountants with strong analytical skills. Businesses expect their accountant to go beyond financial statement preparation to provide strategic business insights. Instead of data entry, reconciliation, and bean counting, we prefer to explore how financial statement data and non-financial metrics can be linked to financial performance and help you make decisions for the future.

Cloud-based accounting and automation have replaced many transactional accounting functions. Bank feeds can automatically import transactions from your bank into your accounting software, AI attempts to categorise transactions based on descriptions downloaded, this combination of automation and AI has significantly reduced the time spent on data entry and the potential for human error.

More than just transactional accounting functions can benefit from automation, think of the possibility of automated reports. Inventory reports, budget to actual comparisons and sales reports that used to take days to run, crashing the system multiple times, could now be scheduled and delivered to your inbox while you sleep, giving you more time to work on your business.

Accounting Services

Outsourced CFOOur Guidance, Your Success

A Chief Financial Officer (CFO) is the financial gatekeeper of a business. Primarily responsible for managing the business’s finances including financial planning, management of financial risk, record keeping and financial reporting. A CFO contributes directly to all strategic and tactical matters relating to budget management, cost-benefit analysis, forecasts, and the securing of new or additional funding.

The CFO is the financial authority within a business, responsible for leading all accounting and finance operations. They must ensure the integrity of fiscal data, modelling transparency and accountability. CFO’s are highly educated and experienced individuals, commanding annual salaries in excess of $250,000 per annum. An Outsourced CFO gives small businesses the advantages of a large corporation, without compromising the quality of advice.

An effective CFO must possess a holistic understanding of the financial workings of their business, and also of their entire industry.

Grow Your Business

Growing your business is often a necessity for survival and economic well-being. There are many growth strategies, all of which have been successful at some point in time for someone’s business. At Collappor8, our consultants understand growth strategies and how to implement them. But most importantly we know what growth strategies will suit your business model.

Implement Better Business Reports

Often business reports give you a feeling or a general view of how well your business is performing. However, in the ever-changing business world, you need accurate, meaningful information at your fingertips to make good decisions. Fast! We help you develop better business reports that will become a valuable tool when contemplating and preparing for your business’s future.

Improve Profit & Cashflow

The purpose of a business is to maximise profit. Increased revenue can come through customer acquisition, better product selection to meet your market needs, proper price setting, or partnership opportunities. Revenue and profit does not mean cash flow. The law requires you to remain solvent, meaning that you have the ability to make payments when due.

Sound-Board

What our clients love most about our service, is the added comfort of having an expert sound-board ready to listen and discuss new ideas, goals, and plans. We see the bigger picture, and since we already understand your business, we are the perfect phone a friend to give you the confidence you are heading in the right direction.

Our Value Proposition

Information in business is the key to being able to make the right decisions at the right time. Business owners should not have to make do with inadequate and poorly timed reports that pose more questions than they answer. Our Outsource CFO is relevant whether you are a start-up or further along in the life cycle of your business.

Collappor8 have the expertise to ensure you optimise the value of your business by interpreting data, telling you what has happened, what is happening and what might happen in a way you can understand, guiding your business in the right direction.

Financial AccountingAnticipating Your Needs

Financial accounting is the branch of accountancy that deals with the preparation and presentation of reports called financial statements. Financial statements include things like profit and loss statements, balance sheets and cash flow statements.

The financial statements present a business’s condition, results of operations, and other information in compliance with accounting standards that are made public to shareholders, financiers, and regulatory bodies.

Together the Cash Flow Statement, Balance Sheet, and Income Statement show the results of past business decisions and reflect the firm’s ability to pay debts and dividends and to finance new growth.

Collect

To prepare a complete and accurate set of financial statements the starting point is always the collection of information. This includes determining all income earned, costs incurred and assets purchased or sold during a specific period. In addition, invoices unpaid by customers, invoices unpaid to suppliers, the balance of stock on hand, details of finance including bank overdraft, business loans, or trade finance, will be required at the date the financial statements are being prepared.

Deliver

Financial statements tell the business’s story. When delivering financial statements, consideration must be given to each component as the profit & loss statement, balance sheet, and cash flow each have something to say about the business, whether read together or in isolation. In addition, notes to the financial statements provide important relevant information that may not be apparent from the numbers alone. When decisions are based on financial statements, getting the story right is critical.

Analysis

Financial statements are fundamental for decision making for a wide range of users including owners, investors and financial institutions. There are various methods of financial statement analysis that could be performed. The type of analysis chosen may vary depending on the decisions the users are trying to make. Financial analysis is a regular process applicable to every business when trying to evaluate past performance, ascertain the current position and predict future performance.

Sound-Board

Our financial accounting sound-board is for business owners and managers who have questions about writing or interpreting financial statements, or really any business-related questions. Business owners should be able to use financial statements for decision making. Talking through financial results and future plans then knowing when strategic advice is required is important. Ever wondered what your banker will think of your financial statements? Get a banker on your side!

Our Value Proposition

Collappor8 have the skills, qualifications and experience to prepare your financial statements in accordance with accounting standards while telling the story of your business in the best way possible. In order to get where you are going, you have to know where you are. Financial Accounting tells us where you have been, and what you’ve got. We build from there.

Management AccountingThe Devil is in the Detail

Management accounting is about making optimal business decisions: a must-have for businesses to survive in complex global markets. Management accountants can provide insight and add stakeholder value through an organisation’s business strategy. They are vital to the financial health of a business by making critical decisions, safeguarding a business’s integrity, and plan for business sustainability.

Management accounting provides information concerned with the daily operations of a business. This information drives the internal management of a business’s finances, business operations, and strategy. It also helps to identify problems within these areas and informs management of possible solutions. Management accounting incorporates current and future developments, market forecasts, and trends in a fluctuating business environment.

Management accounting combines accounting, finance and management with the leading edge techniques needed to drive successful businesses.

Budgeting & Forecasting

Everyone who’s had to manage their own money for any length of time knows that developing a budget is invaluable. A solid budget will help not only track spending but control it. Most business owners and managers find that trying to create a budget for the first time can be extremely difficult, not to mention stressful. The fear of not sticking to a budget or failing is a common reason why businesses don’t have one. It shouldn’t be this way.

Management Decisions

Business owners are faced with countless decisions every day. Management accounting uses information from your operations to produce reports that provide ongoing insight into your business performance, so you and your managers have data-driven input to make everyday decisions. All small business owners should use these reports to help improve decision-making over time, resulting in higher profitability and greater competitive advantage.

Technology & Innovation

Today, you might be using spreadsheets and paper-based processes to manage your business functions. This method used to meet your day-to-day needs, but as the business grows it’s showing its limitations: not handling increased and more complex data needs, and leaving your records vulnerable to costly human error. While you may have outgrown your existing labour-intensive systems, hiring new employees to handle the influx of work isn’t economically feasible. Hello Technology!

Analytics

In the digital age, the enormous amount of data available to a business can be frightening. Collecting the data and running management reports is just the start of the process. Without analysis and interpretation, running management reports is a waste of time and resources. To be successful in today’s market, a business needs the ability to analyse complex data, produce actionable insights, and adapt to new market trends to stay ahead of their competition.

Our Value Proposition

At one point or another, all business owners have probably asked themselves: Are we holding too much inventory? Is this the right time to expand our business? Are we going to have enough cash to pay all our expenses next month? Without management reports, there is no accurate answer to these questions and guessing does not make good business sense. In fact, making decisions and taking action based on a guess could do more harm to your business than taking no action at all. This is where Collappor8 can provide you with accurate, timely, informative management reports. Equipped with this information, we can then work with you to make decisions with confidence ensuring you achieve the strategic goals of your business.

Outsourced Registered Tax AgentWe Create Lasting Value

Tax agents registered with the Tax Practitioners Board are the only people allowed to charge a fee to prepare and lodge your tax return.

A Registered Tax Agent has applied to the Australian Governments Tax Practitioners Board (“TPB”), met rigorous educational, experience and ethical standards, met professional indemnity insurance requirements AND meets the minimum level of professional development and ongoing training each year; you can trust them with the tax lodgements for your business.

Tax Advisory

Taxation is a complex and ever-changing area that affects every part of your business. Staying up to date with tax law takes time and energy you may rather spend elsewhere. However, without understanding the tax implications attached to a transaction, you could find yourself in an unexpected situation. When events occur outside normal business operations, you should seek advice from an expert. It’s their job to stay up to date.

Structural Tax Planning

You have the right to arrange your financial affairs to keep your tax to a minimum. Tax planning uses deductions, exemptions and structures to reduce taxable income, while still meeting compliance and reporting requirements. To maximise opportunities, businesses should start tax planning well before the end of the financial year.

Tax Lodgements

Running a business comes with the responsibility of ensuring tax lodgements are kept up to date. For most business owners, this includes monthly or quarterly Business Activity Statements (BAS) and annual Income Tax Return. Depending on the structure, operation, and industry of your business, additional tax lodgements may be required.

ATO Liason

When you need to contact the ATO, to ask for a private ruling, special consideration, maybe a lodgement or payment extension, or respond to an ATO request or audit, it could be beneficial to have a professional handle matters on your behalf, ensuring that your circumstances are communicated effectively, providing the best chance of a positive outcome.

Our Value Proposition

Collappor8 know what our clients need to lodge and by when, ensuring that our client’s business is compliant by either arranging lodgements* on their behalf or reminding self-lodgers of due dates. The last thing you want as a business owner is your hard earned money being eaten up in ATO or ASIC fines, as ASIC Registered Agents we can help you stay on top of your company’s compliance requirements.

*Currently, Collappor8 outsource tax agent services.

BookkeepingWe Work Collaboratively

Bookkeeping is a necessary part of running a business. When you find that the box of receipts you deliver to your accountant each year is growing, along with your accounting fees, or you have lost control of your finances, it’s getting too big for you to handle on your own, outsourcing your bookkeeping can help your business run more efficiently.

One of the great things about outsourcing bookkeeping is that you can hire someone for the hours you need without worrying about paying a minimum 4-hour shift, workers compensation, superannuation, or sick days. Using our skilled & qualified bookkeepers you can be assured that your business finances are under control, saving you both time and money, and allowing you to get back to running your business.

Good bookkeepers are hard to find. Stop searching… Collappor8 has a team of GREAT ones.

Data Entry

If you find bookkeeping tedious and repetitious, or you don’t do any bookkeeping at all, you’re not alone. If you want your business to work smarter not harder then outsourcing your bookkeeping is a wise choice. In recent years bookkeeping has been transformed by cloud accounting software and automation giving you valuable business insights in the palm of your hand.

Report

When the data entry for your business is up to date, regular review of financial reports: profit and loss, balance sheet, budgets and cash flow forecasts will give you vital information to track the financial performance of your business. They will be able to guide you on what areas need improving, and those that are performing well. When you need more our Collaborative Accounting Team is here.

Technology

Advancement in technology and connectivity means that you no longer need to find one solution that fits all your needs. For example, Zoho One is a suite of 50+ apps that integrate seamlessly, allowing you to choose what your business needs. Apps that can be accessed from almost any device, team chat allowing real-time collaboration and immediate access to information to make informed decisions.

Sound-Board

Our bookkeeper sound-board is the perfect place to start when you have business ideas or questions. You can ask them anything. A good bookkeeper should know your business almost as well as you know it yourself. They can help you due diligence your ideas, set your business’s priorities, and answer simple business questions. They may even help you decide what ideas require professional advice and act as the intermediary between you and your professional advisor.

Our Value Proposition

A bookkeeper will typically charge less per hour than an accountant for services performed, so it makes sense to have the right combination of bookkeepers and accountants for your business. This is where Collappor8’s all in one accounting service is really great. Our outsourced bookkeepers are backed by the entire Collappor8 team, so when your business is growing and you need more strategic advice, we already have your information to provide immediate value.

As a team of problem solvers, we are dedicated to reducing your workload, providing actionable advice that covers, general bookkeeping, reporting, helpful innovations in technology or just a soundboard for your ideas – helping you realise your plans.

At Collappor8, we believe in knowing our customer. We get to know you and your business, we ask questions, we find out what you are trying to achieve. For example, if your business has an internal accounting team you may be looking for an Outsource CFO to step in and help with strategic financial decisions. If you have a bookkeeper you may be looking for a financial accountant to prepare annual financial statements and a tax agent to lodge your annual tax return.

No matter your need, our all in one accounting service means you don’t have to choose just one speciality. You can have them all. Contact Us for a free one-hour consultation, we will help you choose the mix that fits your business.

Less than most. The way we structure the work means you pay for what you need. For example, we don’t provide you with an accountant to do a bookkeeper’s job. All our services are in-house, meaning you save time and money. This process is very efficient, giving you one point of contact if you need it. All our pricing is transparent, and unlike most, we guarantee our services. If you are ever dissatisfied with any part of this service, you can talk directly to one of our partners who will work with you to resolve any issue as quickly as possible.